TurboTax 2023 Essential Users Guide

With

the new tax season upon us, and the thought of Uncle Sam lurking around the corner, the chilling

thought of owing taxes can and will make the hair stand up on the back of your neck.

With

the new tax season upon us, and the thought of Uncle Sam lurking around the corner, the chilling

thought of owing taxes can and will make the hair stand up on the back of your neck.

Fortunately, staying on top of tax liability and minimizing income tax debt happens the be a service TurboTax specializes in. With TurboTax 2023 tax services working in our favor during the new year, there's no need that requires you to have super human tax knowledge.

Our TurboTax 2023 Essential Users Guide will show you how TurboTax is the perfect solution to insuring you get every tax break possible through a fully guided process that makes tax filing easy!.

With the national debt continually soaring to record levels, and our government continuing on its greedy path of special interest favors and tax breaks for the rich, there's no doubt the working class still needs to work harder to insure a fair shake at keeping their head above water, financially.

So now that the tax season is coming into play, and the task at hand is to prepare your 2023 tax return to be filed by April 15 2023 tax filing deadline, I would guess that as your reading this you no doubt feel you'd like to make this task as painless as possible, Right? Well we're here to show you how to you do just that!

The TurboTax 2023 Desktop Software programs estimated release on 11/14/2023 while the online tax filing versions estimated launch is 11/28/2023. So now lets take a look at your first steps you may want to take this tax season.

If you're planning on using TurboTax computer based tax software from a cd or download, review the system requirements below.

TurboTax Computer System Requirements Checklist

For easy installation, make sure your computer meets the minimum requirements.

- Technical Support: www.turbotax.com/support

TurboTax 2023 Windows® OS Requirements

Your computer should meet these standards for TurboTax 2023 CD/Download software installed on a Windows computer.

- Operating System (OS): Windows 7 with Service Pack 1 or newer / Windows 8 / Windows 8.1 / Windows 10

- Processor: Pentium 4 or Later / Athlon or Later

- RAM: 1 GB or more recommended

- Processor Format: 32-bit or 64-bit for PC

- Monitor: 1024x768 or higher recommended

- Internet Connection: For product updates, 56 Kbps modem or broadband

- Hard Disk Space: 650 MB for TurboTax, plus up to 4.5 GB for Microsoft .NET 4.7.2 if not already installed

- Third Party Software: Microsoft .NET 4.7.2 is included with TurboTax Installer

- CD/DVD drive required if installing from a disc

- Printer: Any Windows compatible inkjet or laser printer if printed documents are desired

TurboTax 2023 Mac OS Requirements

Your computer should meet these standards for TurboTax 2023 CD/Download software installed on a Mac computer.

- Operating System: Mac OS Sierra 10.12 or later, 64-bit required. El Capitan not supported.

- Processor: Multi core Intel Processor with 64-bit required

- RAM: 2 GB or more recommended

- Processor Format: Mac = 64-bit processor

- Monitor: 1024x768 screen resolution.

- Internet Connection: For product updates, 56 Kbps modem or broadband

- Hard Disk Space: 650 MB for TurboTax

- CD/DVD drive required if installed from disc

- Printer: Macintosh-compatible inkjet or laser printer if document printing is desired

Additional Technical Information

- Download Size: unit of measure = 200MB

- Download Time: approximately 2 minutes on broadband

TurboTax 2023 Cost: Average Pricing From Sam's Club, Costco, Amazon & Other Retail Establishments

TurboTax CD packaged programs became available on 11/12/2018 at participating retail establishments like Costco and Sam's Club.

Taxpayers can buy TurboTax CD software through retail establishments like these or choose to buy online and download the product over the internet. In today's age most notebook and laptop computers no longer come with installed CD/DVD drives. In this case, purchasing the online download is the best choice. However, if you're still using one of those desktop boat anchors, no doubt you have the drive for CD installation.

If the latter applies and you're ready to buy TurboTax from Costco, Sam's Club, Walmart, Amazon, Staples, Office Depot or many other distributors, then price is a factor you should pay attention to. These prices will vary based on whether federal and state are both included or not.

Average pricing rounds out the 2023 cost of TurboTax Online Editions as follows:

- TurboTax 2023 Basic Federal CD $29.99 or with State $39.99

- TurboTax 2023 Deluxe Federal CD $29.99 or with State $39.99

- TurboTax 2023 Premier Federal CD $54.99 or with State $64.99

- TurboTax 2023 Home Business Federal CD $64.99 or with State $74.99

- TurboTax 2023 Business Federal CD $104.99 or with State $

Keep in mind these are early season prices and can change at any time.

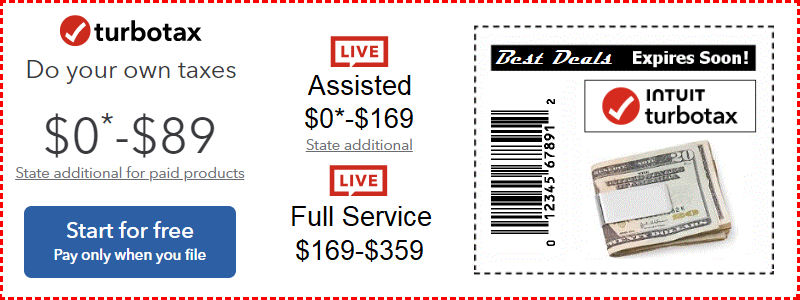

Official TurboTax 2023 Affiliate Discount Pricing

TurboTax Online Filing and Downloads Generally Offer The Best Price Rates. Here are the TurboTax Discount Prices we are able to offer as an Official TurboTax Affiliate Product Distributor based on the cost for each edition.

TurboTax 2023 Online Tax Filing Discount Sale Prices

Use TurboTax 2023 For Guidance With Keeping Up To Date On Current Tax Law Changes.

Tax changes for 2023 and 2023 were signed into law and now they are taking hold on tax payers as they prepare for the April 2023 tax filing deadline. Fortunately TurboTax comes with built in GPS guidance that walks taxpayers through the whole process oe step at a time.

The new tax laws were signed into law in each of the last two years with the most recent TCJA Tax Cuts and Jobs Act enforcing the biggest bill of tax law changes. For most taxpayers, these tax law changes impact the income you earned in 2018 (for the tax return you file in 2023). Overall, the new tax laws may lower taxes for individuals tax filers and small businesses alike.

Some of these new tax law changes include:

- Lower tax rates for individual

- Increased standard deduction benefits

- Increased child tax credit benefits

- The elimination of some itemized deductions

- The elimination of dependent and personal exemptions

- A $10,000 cap on deductions for state income taxes, sales, and local taxes, and property taxes combined

- A 20% deduction for “pass-through” entities (sole proprietorship, partnership, S corp.)

- An increase in expense limits for capital assets

Child Tax Credit Guide (April 15 2023 Tax Filing Changes):

Under the new tax code, the child tax credit increased from $1,000 to $2,000. This applies to tax year 2018 (the tax return you will file by April 2023). In addition, more families will be able to claim the child tax credit because income qualifications increased dramatically.

TurboTax 2023 Free Tax Filing for simple tax returns only "not all taxpayers qualify", will it work for you?

Now

for those of you with simple 1040ez tax returns, there is no reason for you to pay anything

to file your federal tax return. With the TurboTax 2023 Free Edition

you can prepare and efile your return to the IRS

for FREE. You don't have to pay a cent!

Now

for those of you with simple 1040ez tax returns, there is no reason for you to pay anything

to file your federal tax return. With the TurboTax 2023 Free Edition

you can prepare and efile your return to the IRS

for FREE. You don't have to pay a cent!

The former Free Edition is a great program that has no income limitation, so anyone can use it regardless of how much they make so long as you are filing a basic return that requires no special forms, but it is for simple tax returns only "not all taxpayers qualify"

Using TurboTax with it's Step-By-Step Guidance

Once you've chosen the TurboTax 2023 software edition that fits your needs, the step by step guidance kicks in to make your tax filing task a simple and quick process to complete. You will be able to take advantage of any benefits that may apply to your personal tax filing situation.

With over 350 sources for tax deductions, TurboTax makes every effort to insure you get every tax break you can to lower your overall tax bill, or increase your tax refund. It's easy and virtually automatic in 2023 as TurboTax does all the work for you. Give it a try, you'll be glad you did, I promise!!!