Using The TurboTax TaxCaster For Accurate 2023 - 2024 Tax Calculations

TurboTax

can help you calculate your tax return refund, or taxes owed to help you determine your

income tax liability

owed to the IRS.

TurboTax

can help you calculate your tax return refund, or taxes owed to help you determine your

income tax liability

owed to the IRS.

The TurboTax TaxCaster 2023 earned income tax calculator is a great tool to estimate your federal IRS tax amount that will be due on the June 15 2024 new years tax filing deadline.

Calculate your taxes online the easy way, or by using their smart phone TurboTax TaxCaster App so you will know what your obligation is to Uncle Sam...

Calculating your tax estimate with TurboTax TaxCaster

With all the features today's tax software programs have to offer, there is one that seems to get used a lot all through the year. The TurboTax TaxCaster is a great tool that lets you estimate your taxes owed any time of year. There are many great reasons to use this tool often throughout the whole year including:

- To check your income status in an effort to keep from paying too much in to Uncle Sam and make sure that an overpayment isn't earning him interest instead of being in your bank account earning you the interest instead.

- To calculate your taxable income and insure your paying enough in so that you wont be charged a penalty, or interest charge by the IRS for underpaying your withholding or quarterly tax payments on time.

- To get a read on where you stand with the IRS and your taxes in order to plan better for setting aside funds needed to pay your taxes, or, planning on what to invest in with your refund.

Does The TurboTax TaxCaster Perform Accurate Calculations I Can Be Confident In?

It's a great trick question, so I'm going to provide you with my great trick answer. YES if your input data is accurate...

The TurboTax TaxCaster is only as accurate as the information you plug into it is. So to see how accurate TurboTax TaxCaster is, you have to enter accurate financial and tax filing situation information to the questions presented.

If you aren't entering all of your tax deductions, proper amount of withholding you've had deducted from you paycheck, or accurate income figures, obviously it won't be that accurate. Wrong calculations come from inaccurate entries.

On the other hand, if your input data is right on the money, so too will be your calculated result. Accuracy can only be derived from correctly and accurately entered data.

Overall this TurboTax TaxCaster tax Calculation tool is a great feature that can be very helpful all year long in helping you prepare properly so that there are no shocks to your sanity come tax season.

Below we also offer quick links to several options for calculating taxes including our simple tax estimator tool for fast results.

Calculate Tax Return Refund with TurboTax

Calculate Tax Return Refund with HR Block

Estimate Taxes With Our Simple Tax Return Refund Calculator

Here is a list of entries and input data required for tax estimators to perform accurate tax calculations:

- The tax year you are filing (year income was earned)

- Your best fit for your tax filing

status:

- Single Individual

- Married Filing Single

- Married Filing Jointly

- Head of Household

- Qualified Widower

- Your Total Taxable Income, Including unemployment, stock, dividends, etc.

- Your Total Tax Deductions and Benefits, Including Charitable Contributions

- The Number of Exemption Credits You Will Claim

For the best results It is suggested that you calculate your tax refund or liability with the tax calculator that is available through the TurboTax online website service or app that you use to prepare your federal income tax return. All of your tax filing information will be in one place and the tax calculations will be more accurate with this full feature calculation.

TurboTax TaxCaster 2023 Earned Income Calculation

With TaxCaster from TurboTax you can calculate your tax return refund

or income tax liability

anytime of year to see if you need to make an adjustment in paycheck withholdings.

With TaxCaster from TurboTax you can calculate your tax return refund

or income tax liability

anytime of year to see if you need to make an adjustment in paycheck withholdings.

Too little paid in could result in a larger taxes due bill come tax season, and possible underpayment penalties. Too much paid in will put that extra cash in Uncle Sam's pocket so that he gets all the interest earned on your overpayment instead of you.

In this case it may be wise to lower your tax withholdings so that you get to collect that interest and end up with more cash for yourself in each paycheck.

Another good reason to calculate your tax return refund prior to preparing your tax return is to relieve the stress and anxiety that may be lingering due to the unknown. TurboTax TaxCaster can help you do just that. Not knowing what your 2023 tax obligation is can weigh heavy on your sanity. Use a tax refund calculator to remove that uncertainty so you can focus on meeting your tax liability obligation.

TurboTax TaxCaster 2024 Future Tax Forecast

TurboTax TaxCaster now offers the ability to forecast next years taxes based on your predicted income, previous years tax data, and new tax laws that all have an effect on predicting fairly accurate results.

TaxCaster also helps you with the task of finding tax deductions without the need of a tax preparation program. Tax deductions can be very confusing and you may find yourself missing out on some valuable tax breaks that could cost you some substantial savings on your tax bill if you're not guided by quality tax tools like TaxCaster.

For those who are planning to itemize their 2024 tax deductions, it can be difficult for you to know what income tax deductions you may be able to qualify for since each deduction has its own set of requirements for qualification.

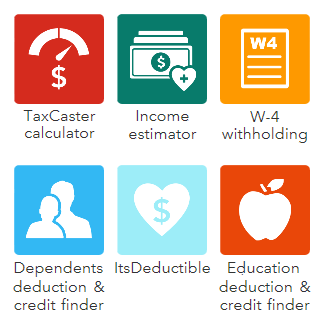

TurboTax TaxCaster App for 2023 - 2024

The TurboTax TaxCaster App offers taxpayers a great tool for on-the-go financial tracking. It's a convenient way to enter tax data on your Smartphone or tablet while as you go so that you don't forget and end up missing out on the tax breaks some entries provide.

The TurboTax TaxCaster downloadable app for your Smartphone operation offers real easy handling that keeps you from pulling your hair out. With easy slide-bar operation you can enter your tax data in a flash and go back to make adjustments as needed.

Let the TurboTax TaxCaster App help you estimate all your federal taxes including Medicare and Social Security. TaxCaster tax refund estimator puts you in the know for your own sanity to avoid the pitfalls of anticipated tax debt syndrome.

TaxCaster Calculates Tax Brackets and Rates For You

Part of the magic comes from this apps ability to merge all your income data with the federal tax brackets along with your federal withholding paid for the tax year to determine your federal tax obligation. However your federal tax rate is actually a variable of all tax rates up to your last dollar earned as each tax rate portion is added together from each tax bracket that income falls within to give you your overall taxes due or refund amount.

As your income increases into each higher tax bracket, that portion of income falling within the next tax bracket is taxed at that higher tax bracket rate. It is then added to the previous tax calculations from the lower tax brackets to determine overall tax liability.

To recap: you are applying different tax rates to each income portion falling within each tax bracket then adding this total together to determine what your tax liability will be. Sounds confusing doesn't it? well TurboTax TaxCaster handles all that for you so trying to understand it is a mute point, just let TaxCaster do the work! Try it today, it truly is one of the best tax time tools you can have in your arsenal.