TurboTax 2023 - 2024 Tax Preparation Software Release Date

The TurboTax 2024 tax preparation software’s release dates from Intuit have been announced, so now you can plan on setting aside some time in your everyday schedule to get a head start on your income taxes early.

When are The IRS 2024 Tax Filing Deadline and TurboTax Tax Software Release Dates For Preparing 2023 Earned Income Tax Returns?

Previous

year release dates for TurboTax tax preparation products have shown some similarity in the fact

that they have fallen within a week of each other in their respective year.

Previous

year release dates for TurboTax tax preparation products have shown some similarity in the fact

that they have fallen within a week of each other in their respective year.

Additionally: previous TurboTax desktop software versions have been released consistently at other venues during this same time of year.

We are excited to announce the Online Launch of the 2023 - 2024 TurboTax tax season to be early December.

Key Dates:

- IRS Tentative e-file Open Date is tentative for 01/22/2024 +-

- TurboTax Desktop Tax Software Release Date estimated 12/03/2023 +-

- TurboTax Online Tax Preparation Launch Date estimated 11/29/2023

- IRS Tax Filing Deadline is Monday, April 15 2024

Historical TurboTax Release Dates:

TBD = to be determined

- TurboTax 2023 release date: December 3, 2023

- TurboTax 2022 release date: December, 2023

- TurboTax 2021 release date: December, 2021

- TurboTax 2020 release date: November, 2020

- TurboTax 2019 release date: November 14, 2019

- TurboTax 2018 release date: November 12, 2018

- TurboTax 2017 release date: November 14, 2017

- TurboTax 2016 release date: November 11, 2016

- TurboTax 2015 release date: November 10, 2015

- TurboTax 2014 release date: November 14, 2014

- TurboTax 2013 release date: November 15, 2013

Important Note On TurboTax Desktop Tax Software:

TurboTax Desktop Tax Software is generally released with the need for updates due to last minute tax code changes. With these early release dates it's wise to check for updates prior to beginning your tax return preparation process.

How Do I Choose The Right TurboTax Software Program For The 2023 - 2024 Tax Season?

It's a great question, with a really simple answer!

TurboTax offers many editions of their tax software as presented below. The key to choosing the right program for your tax filing needs is to simply skim through the brief descriptions below to see which product covers your needs the best. If you're unsure, start with a lighter, lower cost edition, then TurboTax will prompt you to upgrade if the answers you provide during the tax software's interview phase indicate that another edition will be more beneficial for your tax filing situation.

United States TurboTax Tax Software Editions:

TurboTax “simple tax returns only” Free Edition > edition details

- Choose the TurboTax “simple tax returns only” Free Edition if you have a simple return and only need limited tax guidance. This edition works well for any income level and is an easy way to prepare your taxes for FREE. This Edition does NOT cover tax schedules C, D, E, and F

- The TurboTax “simple tax returns only” Free Edition searches for any tax credits you may be eligible for to insure

you get the biggest possible refund, guaranteed.

TurboTax Basic Edition > edition details

- Choose TurboTax BASIC Edition if you are a returning TurboTax user and you file a 1040 or 1040EZ type of tax return and rent or own your home with no mortgage.

- TurboTax Basic Edition makes tax preparation for simple tax returns easy by guiding you one step at a time through your federal tax return filing process. It provides tax-saving tips as it searches for credits to help get you the biggest refund available.

TurboTax Deluxe Edition > edition details

- Choose TurboTax DELUXE Edition if you own your home and have a mortgage, have significant education or medical expenses, have lots of deductions or charitable donations or, if you have childcare expenses That you would like to claim on your taxes.

- TurboTax Deluxe Edition was designed to find all the tax deductions you can qualify

for to maximize your tax refund with 100% accurate guaranteed calculations.

TurboTax Premier Edition > edition details

- Choose TurboTax PREMIER Edition if you own rental properties or are a beneficiary of an estate or trust (received a K-1 form), or if you sold any stocks, bonds, or mutual funds, or if you sold options for an employee stock plan during the tax year.

- TurboTax Online Premier Edition is designed to make sure you're getting the most from

your investments and rental property deductions with top rated step by step guidance.

TurboTax Home & Business Edition > edition details

- Choose TurboTax HOME & BUSINESS Edition if you prepare W-2 and 1099-MISC forms for employees or contractors, if your self employed, receive side job income, or if you're a single-member LLC, sole-proprietor, consultant, or 1099 contractor.

- TurboTax Home and Business Edition is designed to help you file your personal and business taxes together so your personal and business deductions are maximized.

TurboTax Business Edition > edition details

- Choose TurboTax BUSINESS Edition if you have a small business that requires tax filing for the following situations.

- TurboTax Business Edition is the proper choice for Partnerships (Form 1065), Multi-Member LLCs (Form 1065), C Corporations (Form 1120), S Corporations (Form 1120S), Estates and Trusts (Form 1041)

TurboTax Military > TurboTax Military Tax Filing Details

- TurboTax MILITARY Discount Tax Support offers armed force members the opportunity to take advantage of special benefits and free or low cost tax filing that is set up for military personnel and their families.

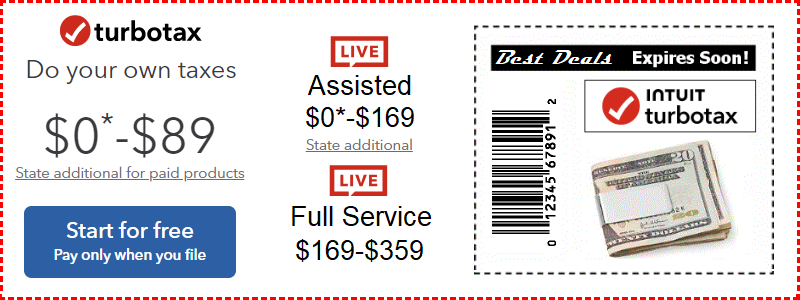

TurboTax Online Tax Preparation Discount Deals

For The 2023 - 2024 Tax Season

As

the #1 selling online tax filing editions along with downloadable and CD software,

TurboTax Online continues to dominate the market

for online tax return preparation. Statistics show that Turbo Tax provides the most stable and

user friendly software packages as they continue to lead the market in consumer satisfaction

and sales. So as TurboTax History

goes, it's a company of engineered growth and innovation with a big appetite for staying number

1.

As

the #1 selling online tax filing editions along with downloadable and CD software,

TurboTax Online continues to dominate the market

for online tax return preparation. Statistics show that Turbo Tax provides the most stable and

user friendly software packages as they continue to lead the market in consumer satisfaction

and sales. So as TurboTax History

goes, it's a company of engineered growth and innovation with a big appetite for staying number

1.

With the start of the tax season under way, Intuit has offered up some of the deepest discounts available for preparing your 2023 earned income tax return with TurboTax. While there will be other discount sale promotions later in the year, I can firmly tell you from several past years experiences, these will be the lowest prices you will see. And with the IRS tax filing deadline set for April 15 2024, locking in your discount now insures you won't miss out later.

Now I'm no rocket scientist, but if you want a great deal, you best giddyup before the early season promotion is over!

So here it is, your discount promotion link to TurboTax Online Programs, Americas #1 Choice - at bargain prices you can take advantage of right NOW!

What's New for TurboTax Users in 2024?

- A new product called TurboTax Live allows users to prepare their taxes with live CPA or EA advice on demand with one-on-one review before filing

- One of the most simplistic features of TurboTax 2024 is the ability to take a picture of your W2 and import that data from the photo onto your tax form

On October 25th 2023 at the Money 20/20 conference TurboTax unveiled the following Intuit Turbo Financial Innovations for 2024 that will collaborate with TurboTax users and their data to help further advance their financial planning and management abilities. Innovations unveiled include:

- Application Pre-Fill: TurboTax users can use their accounts to connect to and pre-fill applications within Turbo, Mint, or trusted financial partner’s applications. This includes data related to over 80,000 fields available on a TurboTax tax return.

- Partnerships: Intuit also unveiled new partnerships with market leaders Lending Club and WealthFront for pre-filling applications and offering personalized investment advice. Existing Intuit partners Marcus, SoFi and Honest Dollar are involved in pre-qualification and personalized offer performance.

- Mintsights™: Mint updates now allow users to see meaningful personalized insights and tips that will assist them in improving their financial health. The Mintsights app from Mint combined with TurboTax knowledge helps users understand their financial behavior while helping them manage and budget their money along with consolidating debt and growing investments.

- Combined Household View: Turbo users can create a shared view for financial data including household income, credit score, and debt to gain a more complete overview picture of their financial strength and abilities to obtain loans with better rates, and get pre-qualify or pre-approved.

TurboTax 2024 Mobile App - It's The Highlight Of Popularity On The Go!

The TurboTax Smartphone Applications are becoming much more widely accepted as popular tax tools. The W2 app, along with others like the TurboTax TaxCaster Calculator are seeing a rise in use as taxpayers on the go can access and use these tools when and where they need to.

With these in hand applications tax filers can work on their taxes for a few minutes at a time while eating lunch or commuting to and from locations, or wherever they have a moment to spare. Additionally the TurboTax benefit assist, itsDeductible app offers a very informative guide to tax deductions and savings.

If your looking for the best online income tax preparation software, the #1 selling online federal and state tax software brand again this year is the TurboTax online tax preparation software product line

TurboTax Downloads and CD's for Desktop Computer Installation and Internet Free Tax Preparation

The TurboTax Download and CD Software Versions of each edition other then the free one are available to those who prefer to install the software on their computer. This enables users to work on their returns without the need of an internet connection. It's a great choice for those that travel around to help out family and friends in preparing their tax returns.

As the market leader, the TurboTax 2023 editions are designed to search out and find every deduction, credit and benefit you can possibly qualify for. With a maximum refund guarantee you can rest assured TurboTax is working hard for you. Try the TurboTax 2024 new years editions and see how intuitive this fully guided tax preparation process can be for your family, and your small business tax filing.

As you look about the internet in an effort to determine which tax software product is the best choice for your filing needs, keep in mind that TurboTax has been the top selling brand of all time, so why would you use anything else? TurboTax Online Tax Filing has become the online tax preparation method of choice for Americans looking for a user friendly way to get their biggest refund on federal and state income tax returns.

As the online tax filing software market heats up every year with new companies jumping into tax software development, Turbo Tax continues to push more diligently with simplifying their intuitive product line to stay the top consumer choice.